tax on venmo payments

By Ryan Cvitkovich Published June 13 2022. Just Fill Out Your Info Including Your Mobile Number Get 10 When You Sign Up For Venmo.

:max_bytes(150000):strip_icc()/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)

How Safe Is Venmo And What Are Its Fees

For most states the threshold is.

. The IRS is not requiring individuals to report or pay taxes on mobile payment app transactions over 600. Individuals who have sold cryptocurrency on Venmo during the 2021 tax year will receive a Gains and Losses Statement irrespective of their state of residence. The transactions you received on Venmo may be taxable.

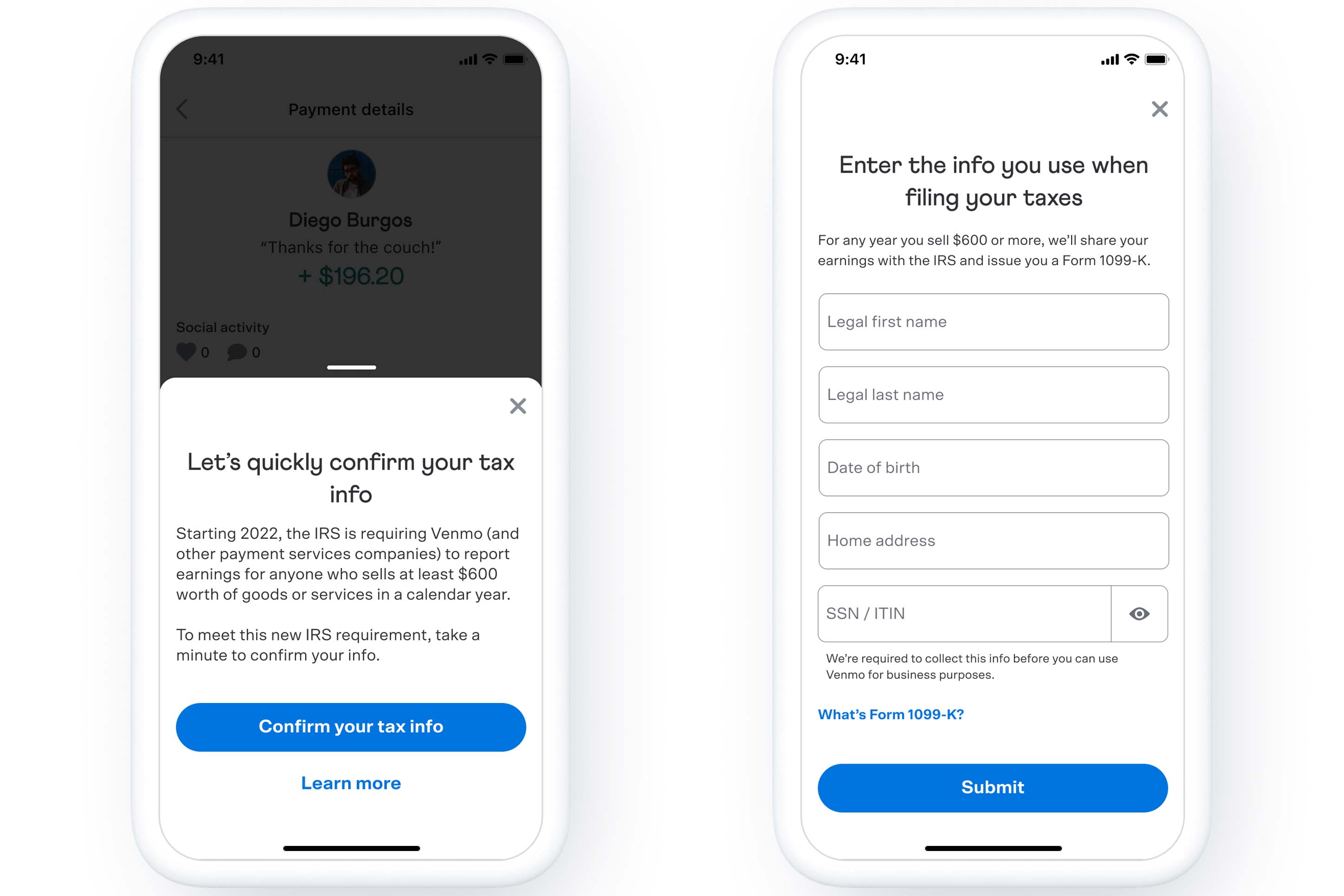

Ad Get 10 When You Sign Up For Venmo. IRS has Begun Imposing a Tax on Venmo Income. Due to lower federal IRS reporting thresholds for 2022 you may need to provide Venmo with your tax information if youre receiving payments for sales of goods and.

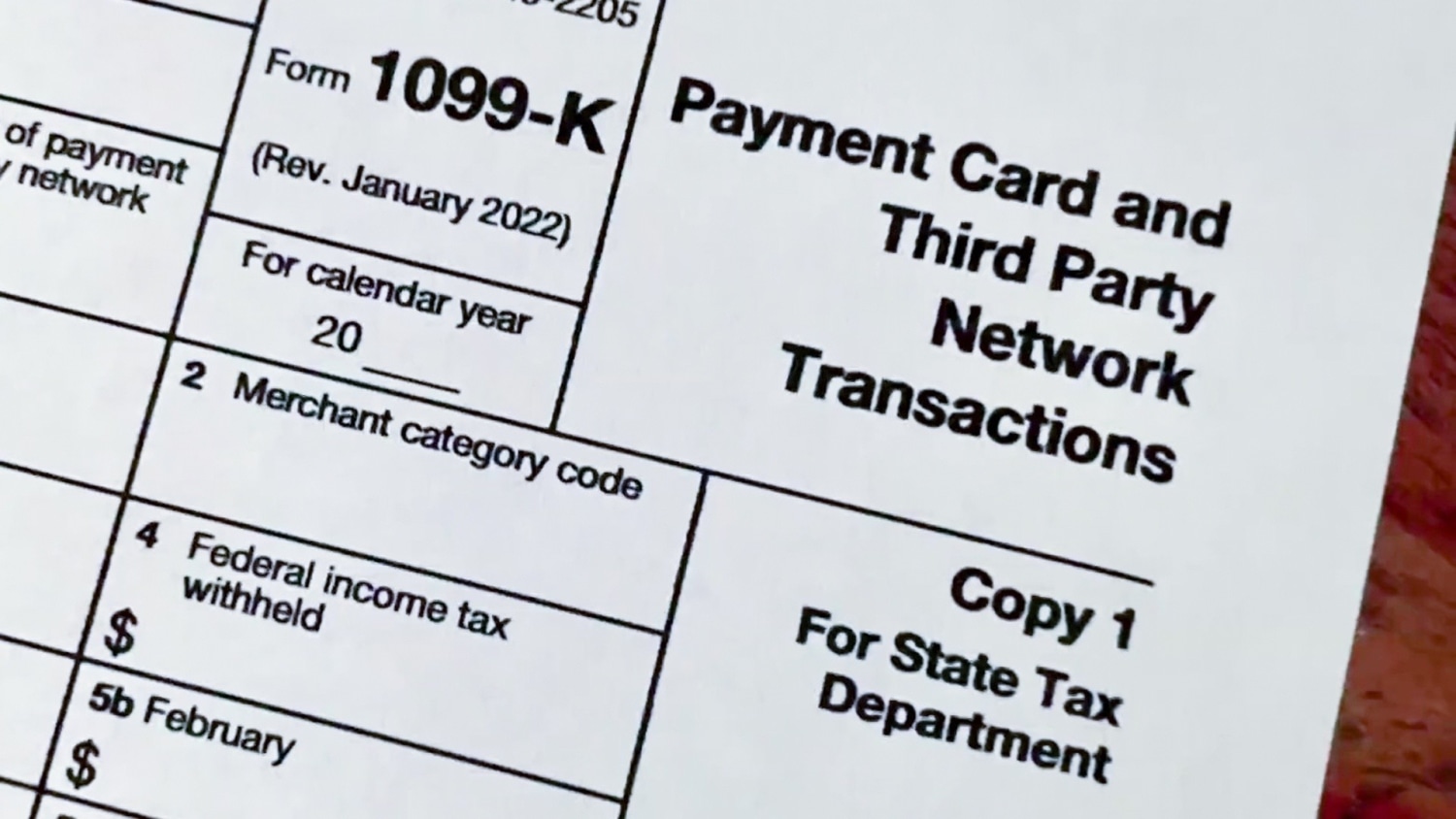

Learn about tax forms and whether you might receive them from Venmo. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. Just Fill Out Your Info Mobile Number.

Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. What are tax holds. Ad Get 10 When You Sign Up For Venmo.

Learn more about what tax. Venmo is a digital wallet that makes money easier for everyone from students to small businesses. Social media posts like this tweet that was published on September 15 have claimed that starting January 2022 if you receive more than 600 per year through third-party.

Side hustlers beware. Any income you make over 600 is now being reported to the Internal Revenue Service by payment apps including eBay Venmo and Airbnb. Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes.

Block Tax Services can answer all your questions about tax compliance for payments from services like Venmo and Zelle. Just Fill Out Your Info Mobile Number. Reporting income from Venmo.

If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the. 1 the IRS said if a person accrues more than 600 annually in commercial payments on an app like Venmo then Venmo must file and furnish a Form 1099. The IRS is not requiring individuals to report or pay taxes on.

If you use PayPal Venmo or other P2P platforms. More than 60 million people use the Venmo app for fast safe. Thats why Venmo is mandated to file and issue taxpayers with Form 1099-K.

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to. If youre among the millions of people who use payment apps like PayPal Venmo Square and other third-party electronic payment networks you could be affected by. Anyone who receives at least.

Now in addition to freelancers and. Venmo has become an increasingly popular way of payment due to. Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to.

What to Expect for Tax Season. Call our office at 410 727-6006 or fill out our. Requesting Updates to Your Tax Forms.

Just Fill Out Your Info Including Your Mobile Number Get 10 When You Sign Up For Venmo. The new Venmo income reporting rules apply to an aggregate of 600 or more in income on goods or services through the calendar year.

Tax Code Change Affects Mobile Payment App The Hawk Newspaper

How To Handle Your Taxes When You Re Paid Through Venmo Paypal And Others Gobankingrates

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

If You Use Venmo Paypal Or Cashapp You Need To Watch This Youtube

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

.jpeg)

New P2p Tax Laws Of 2022 In The Us Simplified Compareremit

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Venmo On Twitter Got Questions About Venmo Amp Taxes Let S Break Down Which Payments Are And Aren T Affected By The 2022 Tax Changes For More Info Head To Https T Co Pwh2p15gl2 Https T Co Behbpcnsxj Twitter

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

New Venmo Tax Law Are You Filing Correctly Behindthechair Com

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc